BMBI: Builders merchants’ sales soar in Q1 2021

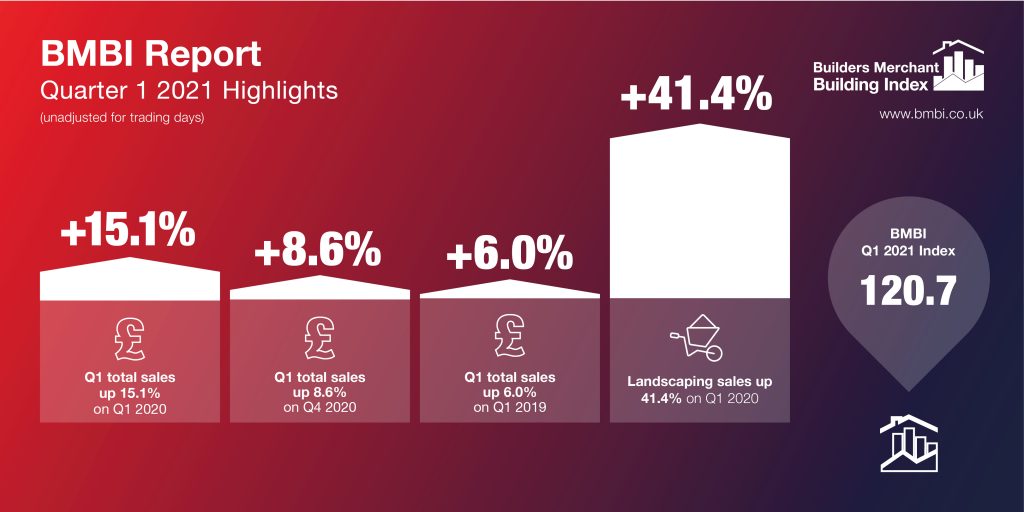

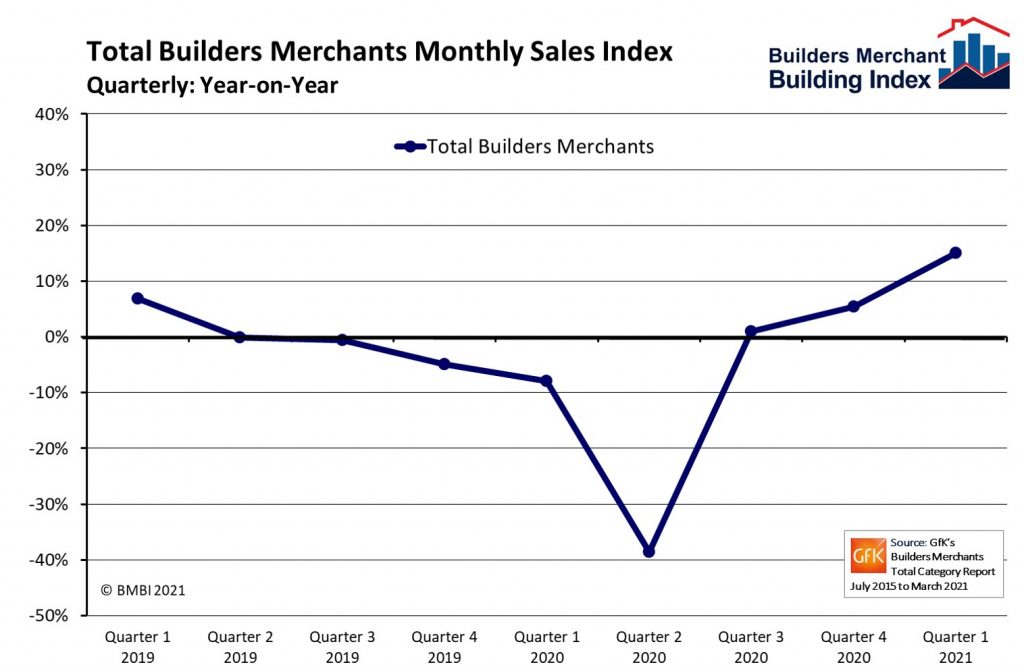

Total value sales to builders and contractors by Britain’s builders’ merchants in Q1 2021 increased 8.6% in comparison to the previous quarter. This is according to the Builders Merchants Building Index (BMBI) report published in May.

Sales surged in March 2021, up 47.4% compared to the same month last year. Removing the effects of COVID, sales were also 23.0% up on March 2019.

Year-on-year

Q1 2021 Total Builders Merchants value sales rose 15.1% compared to Q1 2020 and 6.0% compared to Q1 2019. Landscaping and Timber & Joinery Products saw exceptional growth.

First quarter Landscaping sales were 41.4% up on Q1 2020 and an astonishing 32.3% up on Q1 2019. Over the same periods, Timber & Joinery Products was up 30.5% and 15.8% respectively.

Quarter-on-quarter

Merchants sold more in all but one category compared to Q4 2020. Landscaping (+26.2%) was by far the strongest category over the period. Kitchens & Bathrooms did least well (-2.1%), with showroom closures in the third lockdown proving impactful.

Month-on-month

Total sales grew 38.9% in March 2021 compared to February 2021, with all categories reporting growth month-on-month.

Year-to-date

Although year-to-date sales were lower than the previous 12 months from the impact of COVID-19 closures, overall sales show a remarkably strongly recovery.

Over the full 12 months (April 2020 to March 2021), merchants’ value sales were 5.5% lower than April 2019 to March 2020. Landscaping was the only category to show growth (+15.2%).

Renewables & Water Saving (-18.8%), Kitchens & Bathrooms (-17.5%) and Plumbing, Heating & Electrical (-16.5%) were impacted most.

Index

The BMBI index for Q1 2021 was 120.7. Timber & Joinery Products and Landscaping were the strongest categories, each at 141.5.

Krystal Williams, Managing Director Pavestone is BMBI’s Expert for Natural Stone & Porcelain Paving, comments…

“First quarter market demand is significantly ahead of last year, with volumes more than double compared to Q1 2020. During the first and third lockdowns, homeowners have been spending big on their outdoor spaces and we are hearing that many landscapers have full order books to Christmas 2021.

“This unprecedented demand has brought immense challenges. We’ve seen threefold increases in still-rising shipping costs, as well as container shortages and port congestion limiting exportable volumes and resulting in surcharges on (what feels like) a weekly basis.

“Will the high shipping costs last? Some feel the inflated costs and disruptions will be the new normal for the UK for the next few years, others hope things might settle down by the new year.

COVID and India

“To add to the industry’s woes, most of the UK’s sandstone comes from India and with the country battling to bring COVID infection rates under control, our partners on the ground estimate that just 30% of workers are available, as many have entered voluntary self-isolation or forced lockdown.

“The labour shortage affects the stone processing volume, the timber used for the packaging, and available transportation to port. The result is increased procurement prices.

“We’re hopeful that India’s ports and factories can avoid a national lockdown, and supplies will still get through, albeit at a very reduced rate.

“If they do have to close, there will be even more stock issues, creating pressure on manufacturers reliant on product they only have on the water (4-5 weeks in most cases).

“While supply is challenging, we are encouraging merchants to move away from just-in-time and start planning, and to explore more stable alternatives such as porcelain.

“After India, porcelain is mostly imported from Italy and Poland, which avoids cheap but unsuitable (not anti-slip) products from Turkey and Egypt.

“Increased demand has broadened the scope of what homeowners will look for and what merchants can sell and achieve with landscaping products. The boundaries have been pushed and hopefully this will continue.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities. Visit bmbi.co.uk for the latest reports, Expert comments and Round Table videos.

This article was originally published on BuildingTalk.com in June 2021.