BMBI reports KBB triple digit growth

The Builders Merchant Building Index (BMBI) report, published in August, stated the Kitchens & Bathrooms category bounced back with a triple digit sales increase on Q2 2020.

It also stated the Kitchens & Bathrooms category achieved its highest sales in the last 12 months, up 43.4%

Merchants hit their best ever quarter since the BMBI began in July 2014, with Kitchens & Bathrooms the third highest sales category in Q2 2020.

This is despite Kitchens & Bathrooms being the weakest category in Q2 last year.

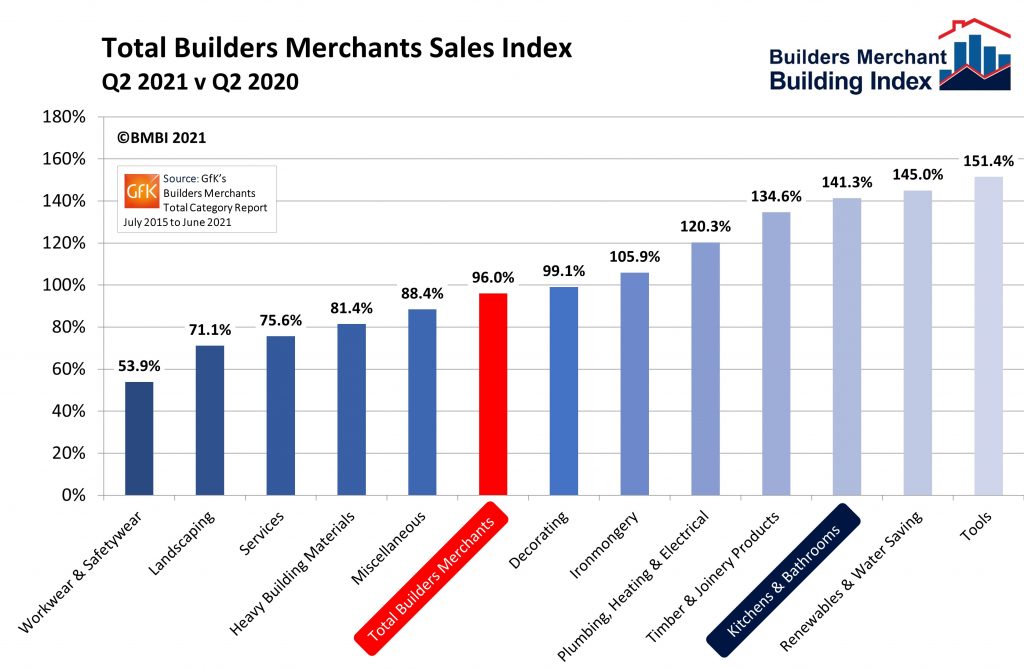

Total Builders Merchants value sales were up 96.0% in Q2 2021 compared to Q2 2020, with no difference in trading days.

Tools experienced the highest year-on-year increase, up 151.4% but Kitchens & Bathrooms also grew 141.3%.

Q2 2021 total value sales were also up 20.3% on Q2 2019, with Kitchens & Bathrooms showing a marginal increase of 1.5%.

Total sales for June 2021 were 29.5% higher than the same month last year, with all categories selling more.

Timber & Joinery Products recorded its highest-ever BMBI monthly sales up 57.5%, despite continuing material shortages, and Kitchens & Bathrooms achieved its highest sales in the last 12 months, up 43.4%.

Q2 total value sales were up 24.1% on Q1 2021 with two less trading days.

Landscaping showed an increase of 67.8% and Timber & Joinery Products up 29.3% were the biggest growth categories, while Kitchens & Bathrooms recorded a “steady” improvement of 8.6%.

Total sales for June 2021 were 11.1% higher than May, helped by three extra trading days.

All categories sold more, including Kitchens & Bathrooms which were up 12.2%, as demand for internal trades continues to grow.

Index

The Q2 BMBI index was 149.7 with one less trading day and the index for Kitchens & Bathrooms was 116.7.

Operations director of Lakes Showering Spaces and BMBI’s Expert for Shower Enclosures & Showering Mick Evans commented on the report: “Half-way through 2021, there are many reasons to be optimistic for internal trades.

“Consumer research points to the home improvement trend gathering pace for internal trades.

“A report on Insight DIY suggests that two thirds of UK homeowners are planning home makeovers in the next year, with a new bathroom the top choice for 32%.

People want more and better spaces in their homes and this is driving the RMI trend.

“The Bank of England says households have accumulated £260bn in their savings accounts since the start of the pandemic.

“According to the research commissioned for Volkswagen Commercial Vehicles two thirds of homeowners are planning to spend up to £135bn of this next year on improving their home.

“Savings and intentions to spend are distributed unequally though as the pandemic has increased the divide between the Haves who are driving a growing market for premium products and high quality improvements, and the Have Nots, homeowners whose outgoings leave little room for such spending.

“However, meeting strong demand for bathroom installations still comes with its challenges.

According to the BIKBBI, almost half of installers (47%) have had to cancel jobs due to being pinged by the NHS Covid app.

The August changes to self-isolation rules should put an end to the ‘ping-demic’ and those unexpected losses, as order books for the remainder of the year are looking healthy.

“Shipping problems are still prevalent. A world economy synchronised by COVID is expanding, driving demand – and shortages – for home improvement and construction products worldwide.

“Components coming from China or the Far East are affected by port congestion at both ends of the journey, and by container shortages and increased freight prices.

“Delays and extra costs are likely to cast a shadow over the industry’s recovery well into the Autumn.

“With the re-introduction of stamp duty, more people are likely to choose to improve not move in the second half of the year.

“These customers will be researching online before they buy, so it’s important to have a strong digital presence, and a personable showroom experience to ensure homeowners get the products they want.”

This article was originally published in Kitchen and Bathroom News September 2021 issue.