Buildingtalk blog: Builders’ merchant sales bounce back in May

Builders’ merchant sales bounce back in May

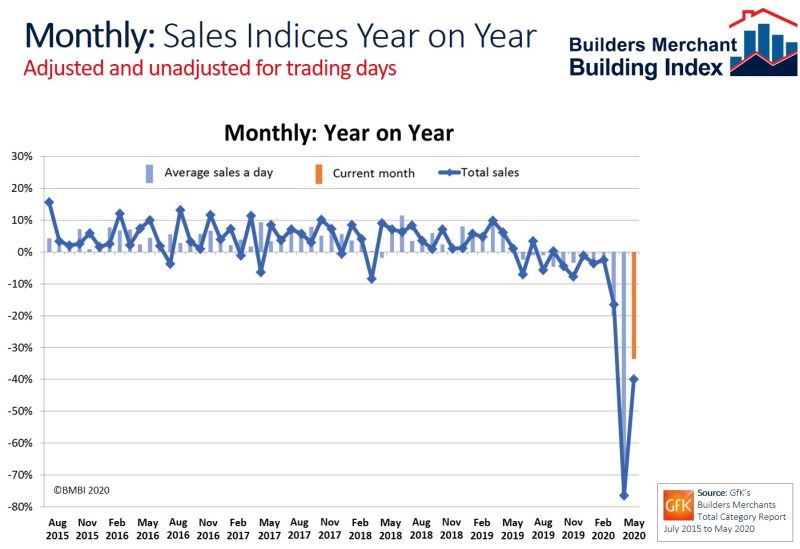

The latest figures from the May Builders Merchant Building Index (BMBI) report reveal a sharp rise in sales as lockdown restrictions ease and trades return to work.

Year-on-year

Total Builders Merchants value sales to builders and contractors in May were down -39.9% compared with May 2019, reflecting the cautious reopening of merchant branches with many still operating a restricted service. However, the overall trading figures are a significant improvement on April 2020 sales (-76.3%).

All categories sold less, with Tools (-66.1%) and Kitchens & Bathrooms (-62.7%) hit hardest by the pandemic lockdown. Heavy Building Materials, the largest product category, was down -39.0% year-on-year.

The biggest winner in May was Landscaping, with sales of this seasonal category down just -12.5% on May 2019. This is a remarkable recovery from April 2020, when sales were down a massive -74.4% on April 2019.

Month-on-month

With April sales at unprecedented levels, May’s partial recovery resulted in some highly unusual month-on-month growth figures. Total merchant value sales were 171.3% above April 2020, with one less trading day this month. Five categories did better, led by Tools (+308%). Landscaping sold 278.9% more than in April and Kitchens & Bathrooms was up by 210.7%. Heavy Building Materials grew more slowly (+157.6%). Average sales a day in May across all merchants were 185.6% higher than in April.

Other periods

Year to date sales in the first five months of 2020 were 29.2% down on January to May 2019, with one less trading day this year. Workwear & Safetywear (-2.7%) did best, boosted by strong demand for protective equipment. The three weakest categories were Tools (-40.4%), Kitchens & Bathrooms (-33.2%) and Timber & Joinery Products (-31.3%).

Index

May’s BMBI index was 78.7. With the exception of seasonal category Landscaping (152.5), all categories were well down.

Andy Scothern, Managing Director eCommonSense and BMBI’s Expert for Website & Product Data Management Solutions, comments: “The far-reaching effects of the coronavirus pandemic will have lasting impacts on all sectors of the economy, including builders’ merchants and their suppliers. Those not planning for the permanent changes in buyer behaviour will be at a significant disadvantage, or worse.

“The builders’ merchant sector was already undergoing massive structural changes due to the changing demographics of the UK workforce and increasing digitalisation. The coronavirus pandemic is accelerating that transformation, with online trade predicted to increase from around 3% to 20% by the end of 2020.

“Continuing to trade while keeping employees and customers safe has persuaded many builders and DIYers to find other ways to order building products, which are delivered without them needing to go into the stores.

“Merchants with integrated websites that include merchant services and organised product data are experiencing record-breaking online sales. Some have seen their website become the highest revenue generating part of their business overnight. Merchants without a fit for purpose digital platform, are having the opposite experience. Phone lines are unable to cope with high call volumes, while sales are lost as customers find merchants with a better online service.

“Retail is already undergoing profound changes, and Covid-19 is accelerating these trends. Business models will need to adapt quickly. Many retailers and merchants are revisiting their digital strategy and investments to provide customers with a compelling omnichannel experience.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities.