Buildingtalk blog – Builders’ Merchants’ Q2 sales: A tale of resilience and recovery

The BMBI results for Quarter 2 show the phenomenal resilience of the sector in action. April, May and June couldn’t have been more different. April, in almost full lockdown, fell -76.5% year-on-year, May recovered to -39.9% as restrictions started to ease, and June grew +2.2%, helped by two more trading days this year, more relaxed restrictions and a booming Landscaping category.

Year-on-year

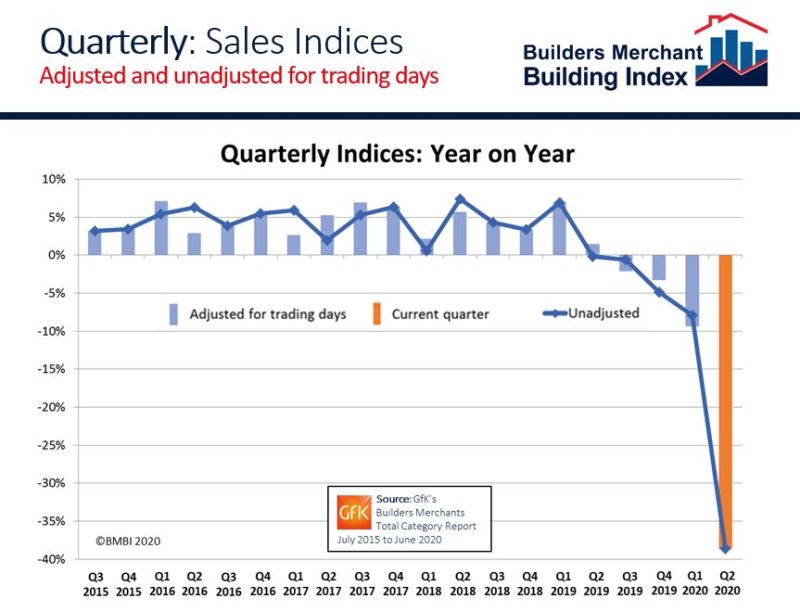

Total Builders Merchants value sales to builders and contractors in Q2 2020 (unadjusted for trading days) fell -38.6% compared with the same period in 2019.

Landscaping the strongest performer, was down -13.3% over the same period. The two largest product categories – Heavy Building Materials and Timber & Joinery Products – fell -38.4% and -39.8% respectively. Tools was weakest (-58.6%), followed by Kitchens & Bathrooms (-57.9%) and Plumbing, Heating & Electrical (-53.1%).

Quarter-on-quarter

Total value sales dropped by -27.2% in Q2 2020 compared with the previous quarter. All categories declined except for Landscaping (+38.7%). Heavy Building Materials was down -26.7% and Timber & Joinery Products by -28.1%.

Index

The quarterly BMBI index for Total Builders Merchants was 76.4, with Heavy Building Materials at 75.1. Landscaping was ahead of all categories with an index of 138.8.

Andrew Simpson, Packed Products Director Hanson Cement and BMBI’s Expert for Cement & Aggregates comments: “Quarter 2 will be remembered and talked about for years to come as the UK went into full lockdown due to Covid-19. Business leaders were faced with tough decisions which had to be made quickly, with mixed advice from the government.

“Businesses quickly closed different parts of their operation, adapting their organisations to stay afloat. Many took advantage of the government furlough scheme and ran with limited resource to match massively reduced sales.

“Due to the level of site closures demand for aggregates, concrete, asphalt and mortar dropped significantly quarter-on-quarter. The Mineral Products Association (MPA) reported that the level of decline in Q2 was equivalent to the total market decline during the financial crisis over the period of 2007 to 2009.

“It was some time before Government guidance for the construction sector was made clear. The message eventually received was that construction is essential so if it was safe to operate we should carry on. As builders’ merchants reopened, they saw a dramatic shift in demand towards heavyside products as people on furlough started home improvement projects. We saw spikes in demand for packed cement, post fixing products, bagged aggregates and decorative aggregates throughout the quarter. Demand for some product lines has been unprecedented and have had to go on allocation from all manufacturers.

“Merchants have seen a swing towards cash sales as consumers spent heavily on improving their homes rather than eating out or going on holiday. Many people who have been working from home have converted spare rooms and installed garden buildings to enable them to work from home comfortably. This may continue into next year as many firms have indicated that they want to reduce travel to the office as people have adjusted so well to home working.

“Given everything that has gone on throughout the pandemic, and new local lockdowns it is very difficult to predict and plan for 2021. The prime minister has made it clear that the building sector is key to recovery and will be keen for housebuilding and infrastructure projects to recover quickly.”

BMBI Experts speak exclusively for their markets, explaining trends, issues and opportunities.