RCI Column – Builders’ Merchants’ sales surge in September

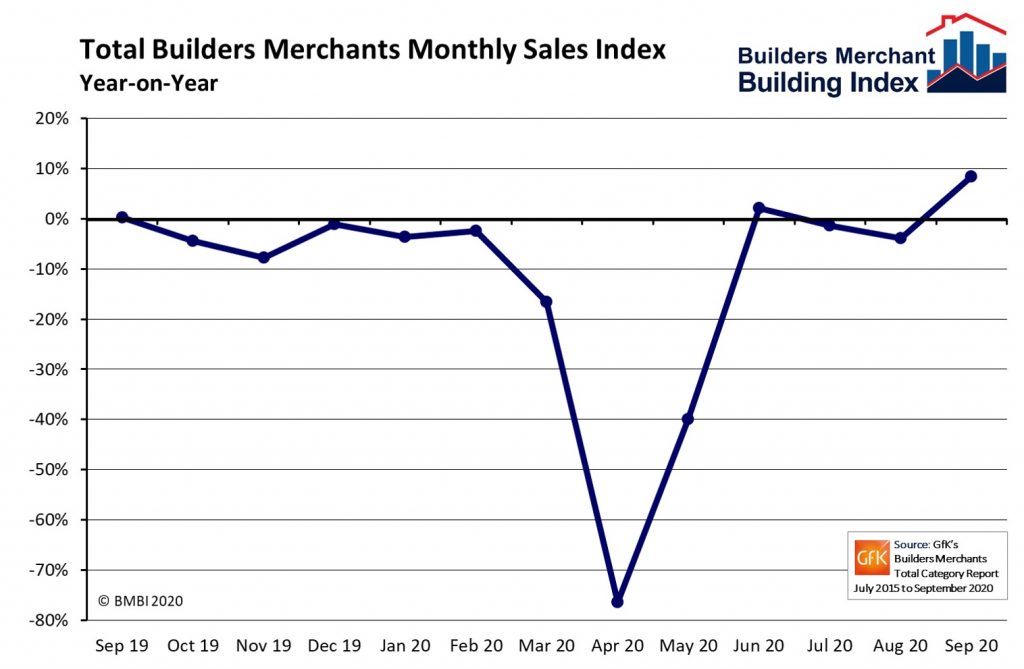

Sales to builders, roofers and contractors by Britain’s builders’ merchants surged in September, with sales up 8.3% compared with September 2019, according to the latest Builders Merchants Building Index (BMBI) report.

Year-on-year

Total Builders Merchants value sales in Q3 2020 increased by 1% compared to Q3 2019. Landscaping sales were up 24.2% – the highest level since the index was set up in 2015. Workwear & Safetywear (+8%), benefited from a continued focus on PPE, while Timber & Joinery sales increased 3.5% over the same period. Heavy Building Materials saw a decrease of -1.0%.

Quarter-on-quarter

Total value sales in Q3 2020 were significantly up on the previous quarter (+63.2%) when many merchants were closed. All product categories reported strong growth.

Month-on-month

Sales across all categories were up in September compared to August, with Total Builders Merchants up 13.7%. The two largest categories – Heavy Building Materials and Timber & Joinery Products – were up 15.4% an 15.6% respectively.

Index

August’s BMBI index was 124.6. Landscaping (175.5) was strongest, followed by Timber & Joinery Products (133.4).

Kevin Tolson, Commercial Director Wienerberger UK and BMBI’s Expert for Bricks & Roof Tiles, comments: “There are few industries as important to the British economy as construction. Making up over 6% of the UK’s GDP and employing about 8% of the nation’s workforce, the sector is a vital cog that helps our country continue to move forward.

“As a key supplier to the industry, our business has mirrored the strong post-Covid recovery seen from July onwards, and there continues to be significant demand for brick and tile building materials. As we experience our second national lockdown, the sector remains open and busy, with producers and distributors of brick and tile staying open to serve customers.

“The recent surge and resulting longer lead times can be attributed to an increase in demand from the major sectors of new build housing, and both public and private RMI (Repair Maintenance & Improvements). Developers are working hard to catch up for time lost due to the impact of COVID’s national lockdown. Public RMI spend has moved to external works, often roofing, due to restrictions on entering people’s houses, while private RMI has seen a boost due to homeowners investing in in their property in lieu of their lost annual holiday.

“During this period, many manufacturers’ production facilities returned to partial or full production. Since then we have worked hard as a manufacturing industry to maximise the production from our factories, while adhering to the required social distancing protocols.

“Customers, particularly merchants and distributors, may have struggled a little more than usual to obtain materials on the spot, and these delays impact building projects large and small. Lead times across the industry as a whole are a little longer than usual and may persist, particularly if demand continues as we expect, and remains strong through to the end of Q1.”