RCI Column – Timber and joinery fuels builders’ merchants’ sales growth in July

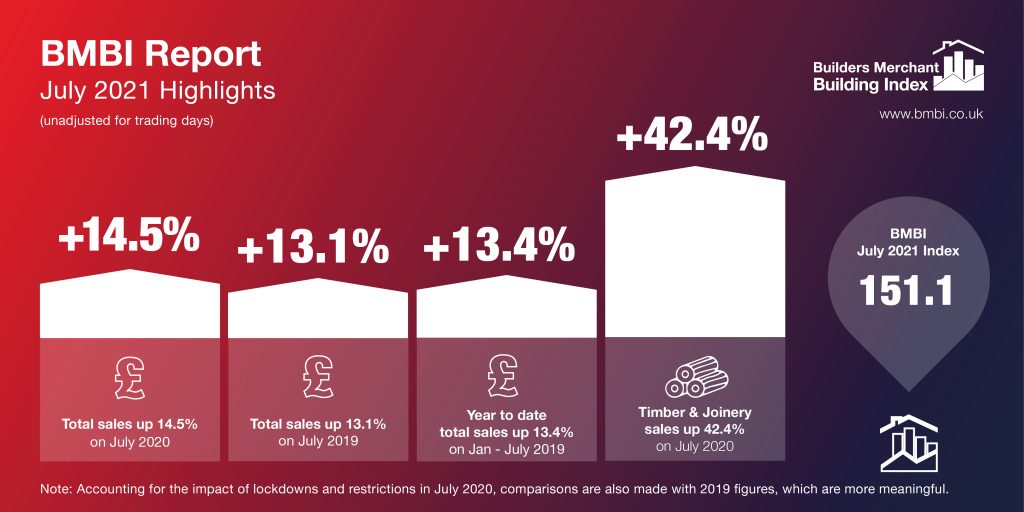

The latest figures from the Builders Merchant Building Index (BMBI), published last month, have revealed that builders’ merchants’ year-on-year value sales to builders, roofers and contractors were 14.5% higher in July, than the same month last year, with two less trading days. The average daily sales in July climbed 25.5%.

The total value sales over the 12-month period were helped by timber and joinery products (+42.4%) recording its highest ever monthly sales since the BMBI report began. Heavy building materials (+8.9%) also performed well compared to the same month a year ago.

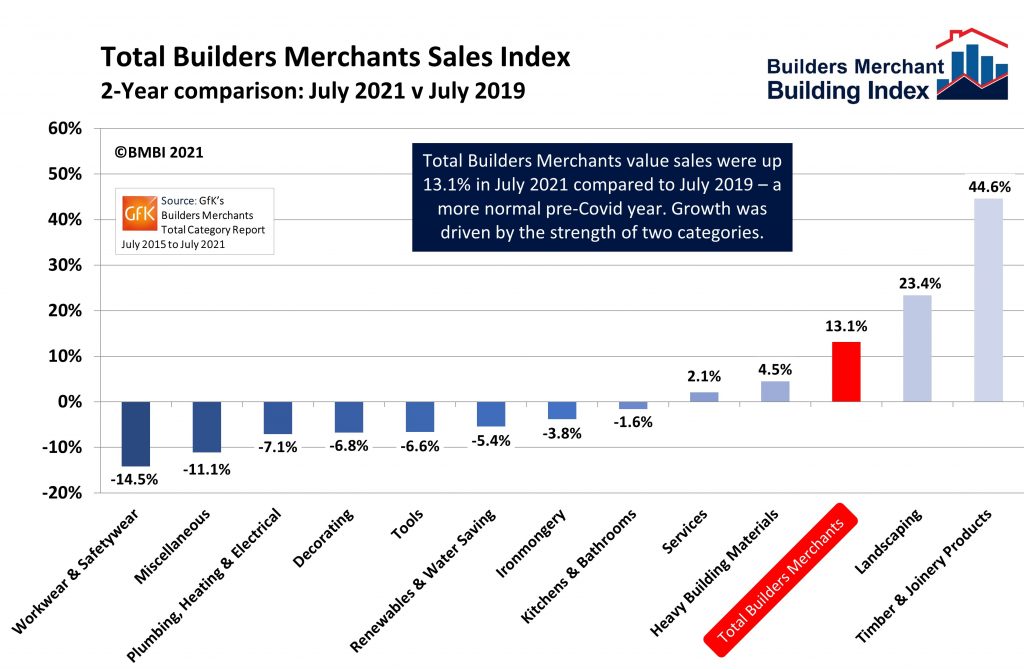

Compared to July 2019, a more normal pre-pandemic year, total merchants’ sales in July 2021 were 13.1% up, with two less trading years this year. Much of this growth was driven by just two categories – timber and joinery products (+44.6%) and landscaping (+23.4%).

Last three months

Total value sales in May to July 2021 were 35.4% higher than the same three months in 2020, with two less trading days this year. Product categories leading the field included timber and joinery products (+64.8%), kitchens and bathrooms (+50.0%), renewables and water saving (+48.8%), plumbing, heating and electrical (+46.5%), and tools (+38.7%). The total sales were also up on the same three months of 2019 (+17.3%).

Month-on-month

After a bumper June, total merchants’ sales for July were 3.8% lower, with one less trading day. Kitchens and bathrooms increased marginally (+1.1%), timber and joinery products was flat (+0.1%), and all other categories sold less than the previous month, including heavy building materials (-4.2%) and landscaping (-12.9%).

Index

July’s BMBI index was 151.1 with strong performances from landscaping (204.8) and timber and joinery products (199.8). Seven other categories exceeded 100, including heavy building materials (136.8).

Neil Hargreaves, managing director at Knauf Insulation, and BMBI’s expert for mineral wool insulation, said:

“Demand for construction materials is still sky-high, as evidenced by the latest BMBI figures, but the same figures show a levelling off compared with previous months. Industry forecasts suggest that isn’t because the economy has finished bouncing back, but because supply issues have become stronger headwinds.

“Merchants face difficulties sourcing many materials, and unfortunately, insulation isn’t immune. The causes have been described as a perfect storm of disruption – with lockdowns, the Suez blockage and Brexit among them. Now we can add the UK’s haulier shortage to the list of reasons we’re experiencing some turbulence, even for materials where stocks remain abundant.”

Neil continued: “The problem is acute, with the Road Haulage Association estimating a current shortfall of 100,000 HGV drivers in the UK, combining a historic deficit with a more recent exodus from the industry. While the government is taking action to deal with the backlog, there are no quick fixes, and we should anticipate continuing disruption for some time to come.

“To reduce the risk of sites shutting down, effective partnerships are part of the answer. Merchants, their suppliers and customers need to work together to make more efficient use of the HGV capacity that is available. Equal measures of collaboration, creativity and patience will be required to optimise ordering and delivery schedules, with close communication throughout.

“As the saying goes, it’s ‘an ill wind that blows no good’. If haulage constraints result in more efficient use of distribution networks and fewer road miles, we’ll cut construction’s carbon emissions. It is a necessary, positive and permanent change for when the wind is at our backs once more.”

This column was published in the October issue of Roofing, Cladding & Insulation Magazine (RCI).